Choosing Card Terminals in Hospitality: Key Considerations

By Alexander -

May 20, 2025

- 7 minutes read

Key Considerations for Card Terminals in Hospitality

Choosing the right card terminal starts with understanding your specific requirements. Remember, a card terminal is not a magic solution but a tool to expedite transactions. It's the seamless integration with your POS that often outweighs the standalone features of the terminal.

Consider these functionalities when making your choice:

Contactless & Mobile

Speeds up transactions, reducing physical interaction

This is possible through your card terminal.

Tip Prompt

A visible nudge to encourage gratuity.

Let your POS software handle how tips are processed.

POS Integration

Automated data entry for fewer errors.

Your hospitality POS must handle raised amounts for tips or "cashless cash" transactions and forward them to the terminal.

Loyalty Linking

No need for separate scanners for loyalty cards or discounts.

The POS should efficiently process loyalty cards, with the terminal acting primarily as a scanner.

Multilingual Interface

Enhances experience for tourists.

Ensure your POS with card terminal supports this feature.

QR Payments

An alternative for guests without a card.

QR payments can be initiated through a Tap to Pay app or POS software.

End-to-End Encryption

Minimizes fraud and chargebacks.

This is a legal requirement.

Cloud Dashboard

Real-time transaction data, peak hours, and ticket sizes.

An ideal POS with card terminal for hospitality keeps everything centralized, offering you one access point.

Split-Bill Function

Allows groups to share the bill easily.

Your POS must handle the split to track which items associate with which payment. The terminal only knows the total, not the sales breakdown.

Offline Mode

Keeps payments functioning during short internet outages.

Some payment providers support offline transactions. Customers can pay up to an agreed amount, with the actual transaction completing when services resume online.

Modern devices combine these features into one user-friendly package. A good card terminal should feel intuitive to guests, even if they're using it for the first time.

Consider these functionalities when making your choice:

Contactless & Mobile

Speeds up transactions, reducing physical interaction

This is possible through your card terminal.

Tip Prompt

A visible nudge to encourage gratuity.

Let your POS software handle how tips are processed.

POS Integration

Automated data entry for fewer errors.

Your hospitality POS must handle raised amounts for tips or "cashless cash" transactions and forward them to the terminal.

Loyalty Linking

No need for separate scanners for loyalty cards or discounts.

The POS should efficiently process loyalty cards, with the terminal acting primarily as a scanner.

Multilingual Interface

Enhances experience for tourists.

Ensure your POS with card terminal supports this feature.

QR Payments

An alternative for guests without a card.

QR payments can be initiated through a Tap to Pay app or POS software.

End-to-End Encryption

Minimizes fraud and chargebacks.

This is a legal requirement.

Cloud Dashboard

Real-time transaction data, peak hours, and ticket sizes.

An ideal POS with card terminal for hospitality keeps everything centralized, offering you one access point.

Split-Bill Function

Allows groups to share the bill easily.

Your POS must handle the split to track which items associate with which payment. The terminal only knows the total, not the sales breakdown.

Offline Mode

Keeps payments functioning during short internet outages.

Some payment providers support offline transactions. Customers can pay up to an agreed amount, with the actual transaction completing when services resume online.

Modern devices combine these features into one user-friendly package. A good card terminal should feel intuitive to guests, even if they're using it for the first time.

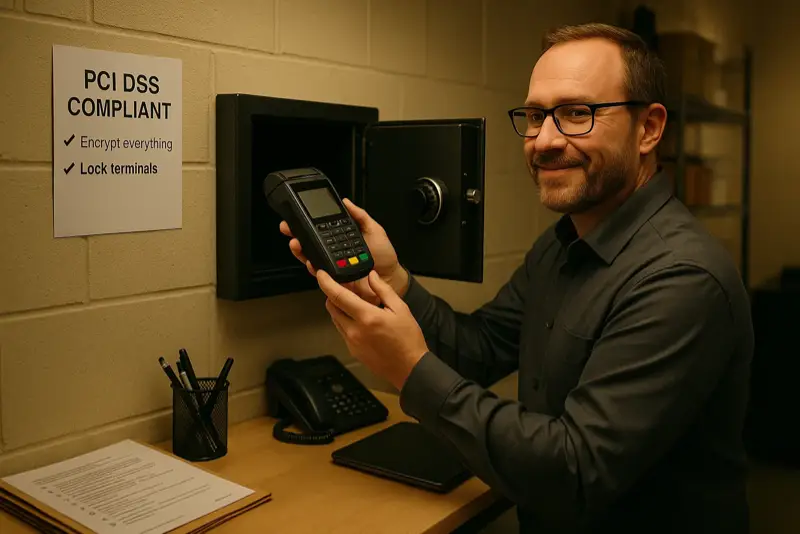

Secure storage of card terminals. Photo Illustration: © HRC DIGITAL B.V.

Security and Compliance

Encryption standards like PCI DSS and point-to-point encryption are mandatory for all providers.

Adopt these "best practices":

Physical Control

Store devices in a locked drawer or safe after hours.

Prevent unauthorized access to equipment.

Regular Inspection

Check for skimming devices around card slots.

Train staff to recognize irregularities.

Access Management

Grant managers more rights than serving staff to limit refund fraud.

Track who cancels or reverses transactions.

Peace of Mind

Increased security also boosts staff peace of mind. As a cafe owner from Rotterdam notes, "My staff feels safer now that we keep less cash on hand. Especially at closing time, there's more peace of mind knowing we're not carrying large amounts through the street."

Adopt these "best practices":

Physical Control

Store devices in a locked drawer or safe after hours.

Prevent unauthorized access to equipment.

Regular Inspection

Check for skimming devices around card slots.

Train staff to recognize irregularities.

Access Management

Grant managers more rights than serving staff to limit refund fraud.

Track who cancels or reverses transactions.

Peace of Mind

Increased security also boosts staff peace of mind. As a cafe owner from Rotterdam notes, "My staff feels safer now that we keep less cash on hand. Especially at closing time, there's more peace of mind knowing we're not carrying large amounts through the street."

A tricky choice: buy or lease? Photo Illustration: © HRC DIGITAL B.V.

Cost Structure

- Buying a card terminal requires an upfront investment of €350.00 to €1,200.00 but leads to lower monthly costs.

- Renting or leasing from €20.00 to €60.00 per month offers flexibility, with maintenance and replacement usually included.

- Fixed service costs such as subscriptions and replacement fees.

- Variable transaction fees for debit cards, credit cards, MAESTRO, and VPay.

- Evaluate your annual transaction volume and average transaction amount.

High Volumes?

Often, it's worthwhile to request a personalized offer.

Connectivity

Check your fixed internet connection and test the stability of your WiFi. Ensure a fallback to 4G or 5G that switches automatically upon failure. ALWAYS use a separate network that guests can't access.

For guests, you might use the 2.4GHz frequency and for internal use, the 5GHz frequency. Or vice versa, according to your equipment's capabilities. Test the connection during peak times when individuals are heavily using the network. Prioritize card terminal and POS connectivity in the router.

Battery and Print Capacity

A battery should last at least 4 to 8 hours, ideally through a full shift. Print rolls should be easy to replace without tools. Consider the option to email receipts to save on paper.

Software Updates

Request automatic firmware updates from suppliers for new payment methods and security enhancements. Ensure updates occur quickly or overnight to minimize disruption during busy times.

Service Desk and Replacement Guarantee

A device failure on a Saturday night can be costly. Review SLA (Service Level Agreements) carefully. Inquire about replacement equipment within 24 hours for faults. Always have a plan B and never rely on a single terminal. Keep a spare terminal or use a Tap to Pay solution with your phone.

As Johan Cruijff reportedly said, "You only realize what you're missing once it's gone."

The future? Photo Illustration: © HRC DIGITAL B.V.

The Future: Seven Trends to Watch Now

Trends and Impact on the Hospitality Sector

- SaaS platforms.

- Contactless becomes standard. Contactless PIN limits rising annually as magnetic stripe cards phase out. By 2025, 90% of all card transactions are expected to be contactless.

- Biometric Verification. Fingerprint or facial recognition on phones replaces PIN codes, speeding up high-ticket transactions while enhancing security.

- Decentralized Wallets. Stablecoins and regulated cryptos can lower transaction fees, especially internationally. Though nascent, progressive establishments are experimenting with these payment methods.

- AI-driven Upsell. POS systems offer real-time upsell suggestions based on order history and time, making "Customers who bought this often ordered..." a reality in hospitality.

- Payment providers increasingly offer all-in-one bundles with analytics, loyalty, and marketing, simplifying the tech landscape for hospitality entrepreneurs.

- Entrepreneurs opting for modular, API-friendly hardware and software today can easily adopt these innovations without significant new investments later.

Lisa serving lunch. Photo Illustration: © HRC DIGITAL B.V.

A Day in Practice: A Timeline in Lisa's Lunch Café

11:45 AM Influx of office clients

Staff processes ten transactions in under two minutes, all contactless. Staff can quickly return to work.

1:00 PM Tourists without a local bank card

International schemes are automatically recognized, and the terminal displays an English menu. Tourists are relieved to pay without local currency.

3:30 PM Afternoon Lull

Dashboard alert: "Revenue below expectations." Lisa launches a two-for-one smoothie offer via POS, payable by QR code. Profits rise within the hour.

5:45 PM Staff settles personal purchases

Management permissions required for staff discounts, all logged for accounting. Transparency prevents misunderstandings.

7:30 PM Group of twelve wants to split

Terminal supports split-bill, four guests pay contactless, eight enter PIN codes. No hassles with "who had what" and cash sharing.

10:15 PM Cashing Up

Two-minute export to accounting software, payment file automatically sent to an accountant. Lisa heads home earlier.

Whether you run a food truck, a Michelin-starred restaurant, or a pop-up bar, the message is clear: a modern card terminal is essential for a modern hospitality business. Those who leverage it wisely gain valuable time, build better customer relationships, and prepare their business for the future of technology.

As Lisa sums it up: "My card terminal might be the best investment I've made in my business. It's not only reduced my administrative burden but also boosted my sales and improved customer experience. In modern hospitality, it's no longer a luxury—it's a necessity."

Staff processes ten transactions in under two minutes, all contactless. Staff can quickly return to work.

1:00 PM Tourists without a local bank card

International schemes are automatically recognized, and the terminal displays an English menu. Tourists are relieved to pay without local currency.

3:30 PM Afternoon Lull

Dashboard alert: "Revenue below expectations." Lisa launches a two-for-one smoothie offer via POS, payable by QR code. Profits rise within the hour.

5:45 PM Staff settles personal purchases

Management permissions required for staff discounts, all logged for accounting. Transparency prevents misunderstandings.

7:30 PM Group of twelve wants to split

Terminal supports split-bill, four guests pay contactless, eight enter PIN codes. No hassles with "who had what" and cash sharing.

10:15 PM Cashing Up

Two-minute export to accounting software, payment file automatically sent to an accountant. Lisa heads home earlier.

Whether you run a food truck, a Michelin-starred restaurant, or a pop-up bar, the message is clear: a modern card terminal is essential for a modern hospitality business. Those who leverage it wisely gain valuable time, build better customer relationships, and prepare their business for the future of technology.

As Lisa sums it up: "My card terminal might be the best investment I've made in my business. It's not only reduced my administrative burden but also boosted my sales and improved customer experience. In modern hospitality, it's no longer a luxury—it's a necessity."

Critical Considerations and Practical Tips

- Never completely eliminate cash. Outages happen. Keeping a small cash reserve prevents awkward situations. Retain about 5% of your average daily revenue in cash. Train staff on basic scenarios. A card is declined, there’s a connectivity issue, the customer wants to pay with cash after all. Role-play scenarios to prepare for common outages, changes, and issues.

- Review transaction fees every six months. Volumes may grow faster than expected. As sales increase, negotiating can lead to savings.

- Prioritize guest experience. An over-aggressive tip prompt may backfire. Opt for tactful default amounts. Studies show a 10-15% tip suggestion is most effective; higher percentages may deter guests.

- Consider multiple terminals. For larger venues, a single card terminal can become a bottleneck. Calculate peak transactions per hour and align your equipment accordingly. Tap to Pay can assist during peak times.

- Use the e-receipt option when time-saving. More guests appreciate a digital receipt over paper. It’s not only more sustainable but also cost-effective over time. However, entering personal information takes time too.